federal tax abatement meaning

In broad terms an abatement is any reduction of an individual or corporations tax liability. Tax returns IRC 6651 a 1.

5 12 3 Lien Release And Related Topics Internal Revenue Service

The federal tax abatement is equal to 10 of taxable income earned in.

. IRS Definition of IRS Penalty Abatement. The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. A tax abatement is when a taxpayers tax bill or tax liability is reduced or even brought to zero for a certain period of time and depending on various eligibility.

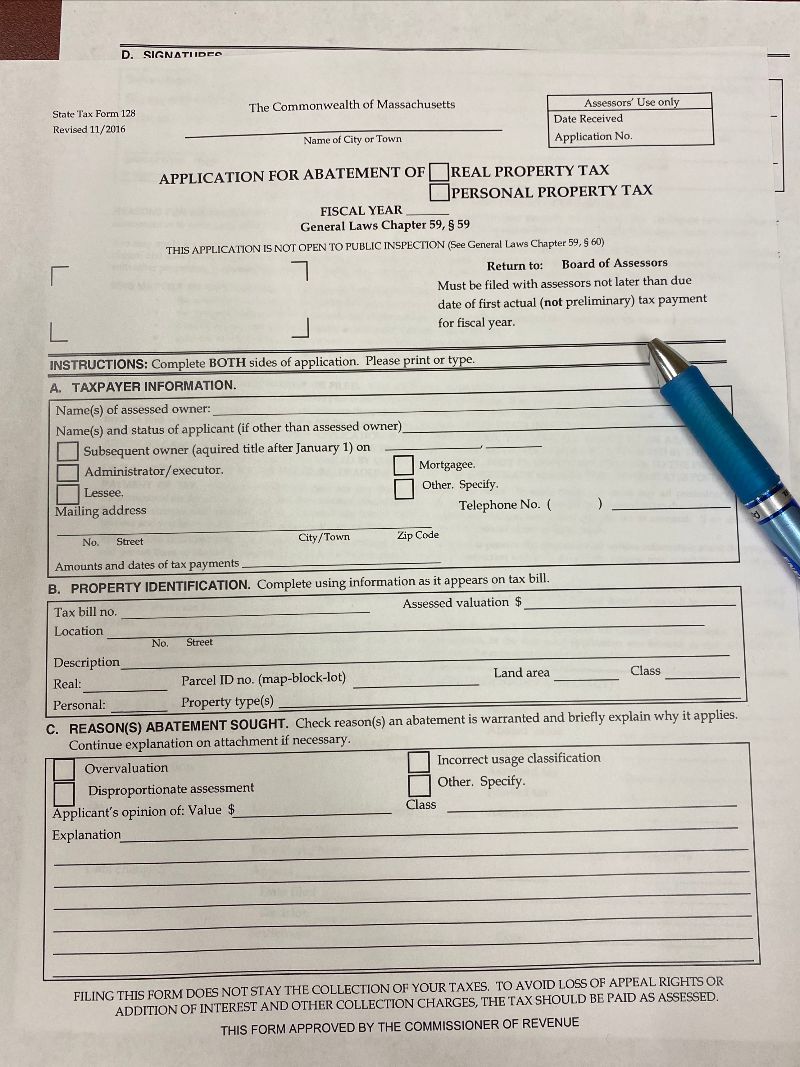

Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. This can help site. Taxpayers use Form 843 to claim a.

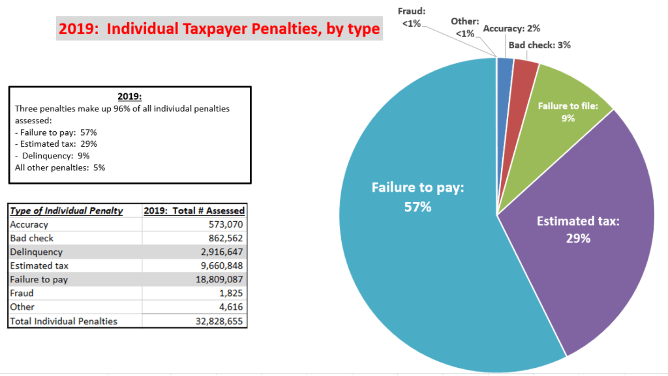

Penalty abatement is a federal relief program designed to help those whove made a mistake and have incurred penalties. If the IRS has assessed a penalty against you. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax.

Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. Reasons that qualify for relief due to reasonable cause depend on the type of penalty you owe and the laws in the Internal Revenue Code IRC for each penalty. Your property tax bill will be lower.

An exemption is a reduction or credit towards the real. The IRS penalizes taxpayers for failing to timely file their federal income tax returns or for failing to timely pay their federal income. Tax Abatement Definition Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate.

Failure to File when the penalty is applied to. The term commonly refers to tax incentives that. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

In most jurisdictions there are. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. Tax abatements are incentives granted by the government to reduce the amount of tax paid by individuals and businesses on assets like properties.

January 26 2018 1 min read. An abatement is a decrease in the assessed valuation of a property resulting in a reduction in the yearly real estate taxes. Line 608 Federal tax abatement The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory.

Penalties eligible for First Time Abate include. Federal Income Tax Penalty Abatement. The federal tax abatement reduces Part I tax payable.

Taking advantage of federal state and local tax incentives and credits allows a brownfield developer to use resources normally spent to pay taxes for other purposes. Penalties Eligible for First Time Abate. The federal tax abatement reduces.

Tax Abatements Alabama Department Of Revenue

Philadelphia 10 Year Tax Abatement Changes What You Need To Know Nj Lenders Corp

Irs Penalties Interest Penalty Abatement Cut Back Taxes Debt Com

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

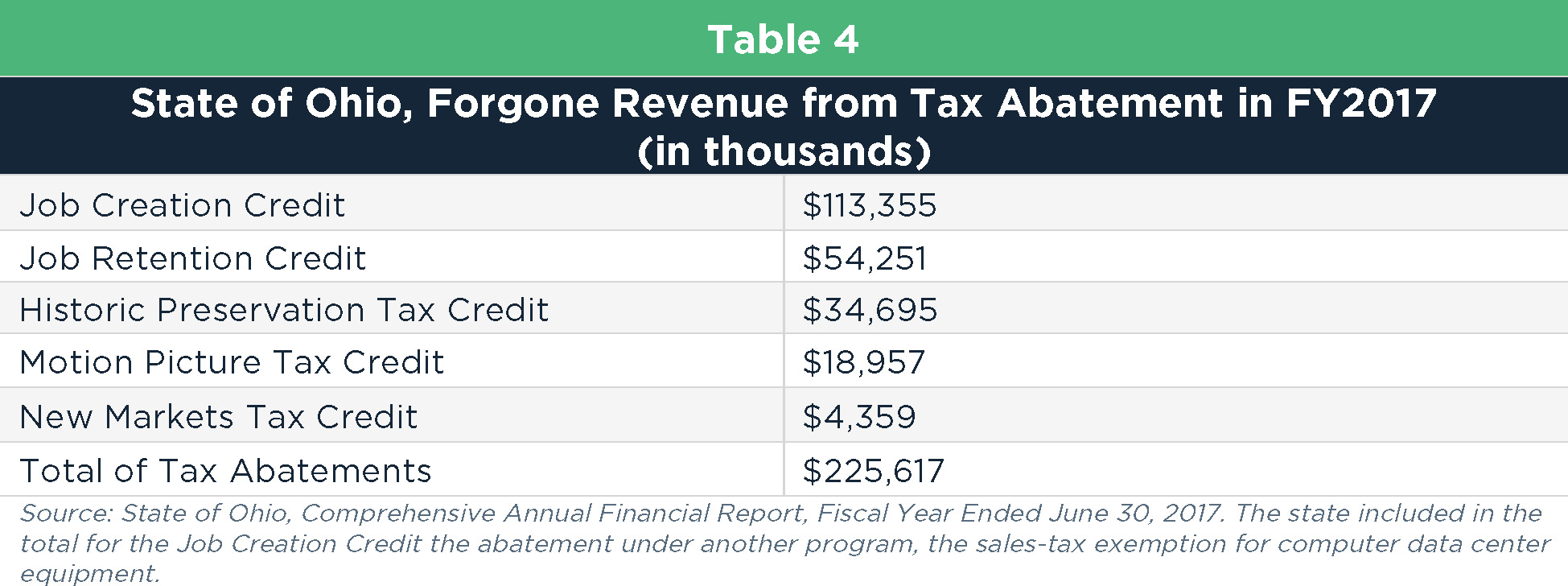

Local Tax Abatement In Ohio A Flash Of Transparency

Occidental Seeks Texas Property Tax Abatements To Help Finance Its Long Shot Plan For Removing Carbon Dioxide From The Atmosphere Inside Climate News

How To Get A Property Tax Abatement For A Rental Income Property In Massachusetts Masslandlords Net

Tax Penalty Abatement Waiver Of Tax Penalties Help In California

Irs Notice Cp215 Notice Of Penalty Charge H R Block

How Much Is The Coop Condo Tax Abatement In Nyc

20 1 9 International Penalties Internal Revenue Service

How To Remove Irs Tax Penalties In 3 Easy Steps The Irs Penalty Abatement Guide Get Rid Of Tax Problems Stop Irs Collections

4 Ny Solar Incentives For Homeowners Brooklyn Solarworks

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

Tax Abatements Alabama Department Of Revenue

Am I Eligible For Tax Abatement

Tax Abatement Means Vs Tax Exemption Explained Youtube

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition